Automation is no longer reserved for large institutional desks. Retail traders, particularly prop firm traders, are running everything from lightweight MT5 expert advisors to fully scripted futures strategies via low latency APIs. At the same time, prop firms are tightening rule sets around high frequency approaches, news trading and latency arbitrage. Understanding the current landscape of APIs, latency and co location helps traders design strategies that are robust, compliant and realistic.

At a glance

- Automation is no longer reserved for large institutional desks.

- Trading APIs can be grouped into three main categories.

- Latency obsession can lead retail traders down unproductive rabbit holes.

- True exchange co location remains largely an institutional game.

- The more automated the strategy, the more important it is to have robust risk and safety mechanisms.

APIs: From Convenience to Core Infrastructure

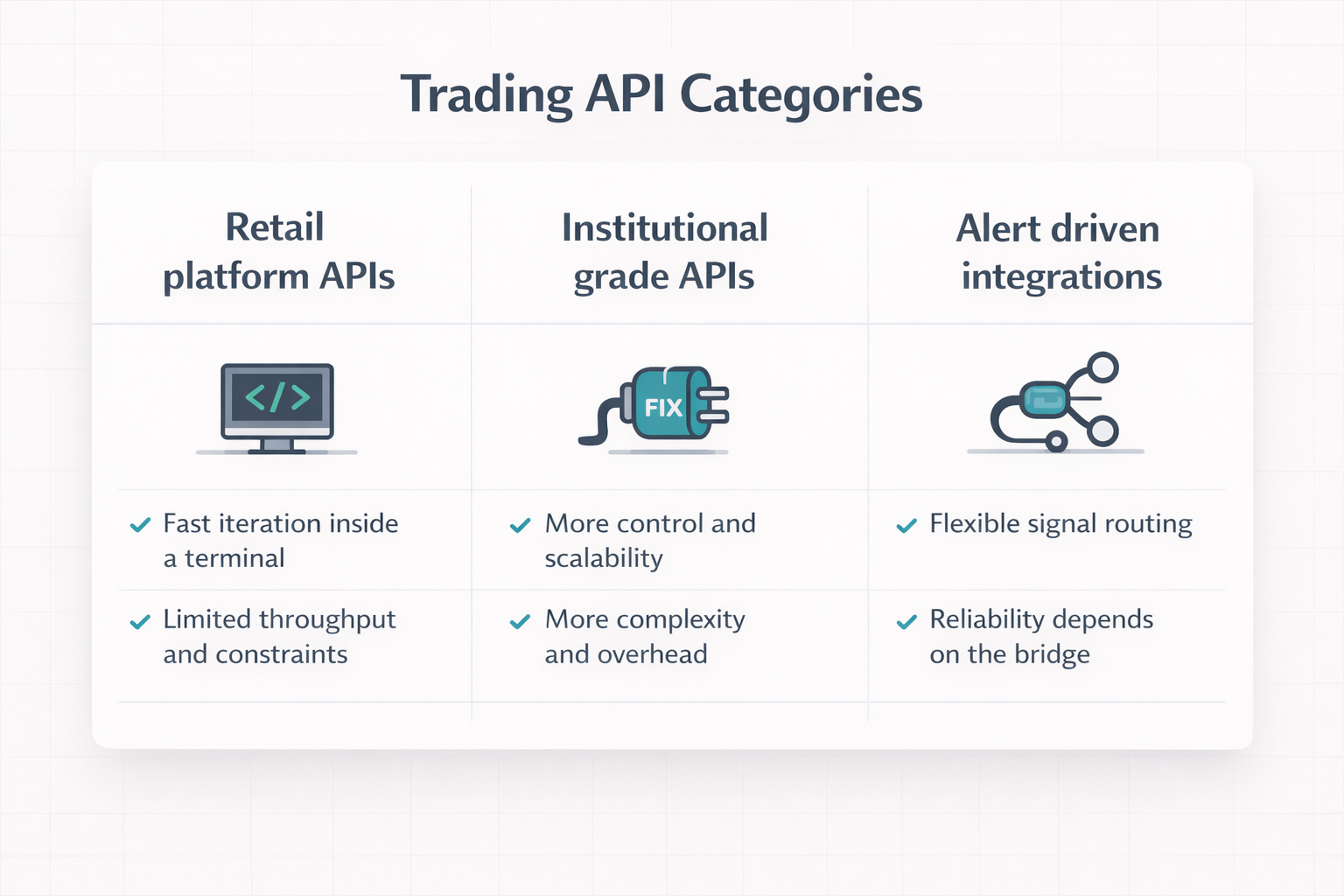

Trading APIs can be grouped into three main categories.

Retail platform APIs. For example, bridges around MT5, NinjaTrader or Quantower. These often expose order placement, position queries and basic data streaming.

Institutional grade APIs. FIX or low level APIs from providers like Rithmic, CQG or TT, offering higher throughput and more granular control at the cost of complexity.

Alert driven integrations. Systems where signals are generated in one environment, for example TradingView alerts, and routed via webhooks or middleware to execute trades on another account.

For prop traders, the key questions are:

- Does the prop firm permit API or EA based trading in the specific program you are using?

- Are there order count limits or rules against tick scalping or latency exploitation?

- Is the API connection direct to the firm’s infrastructure, or routed through a third party bridge that can fail or impose throttling?

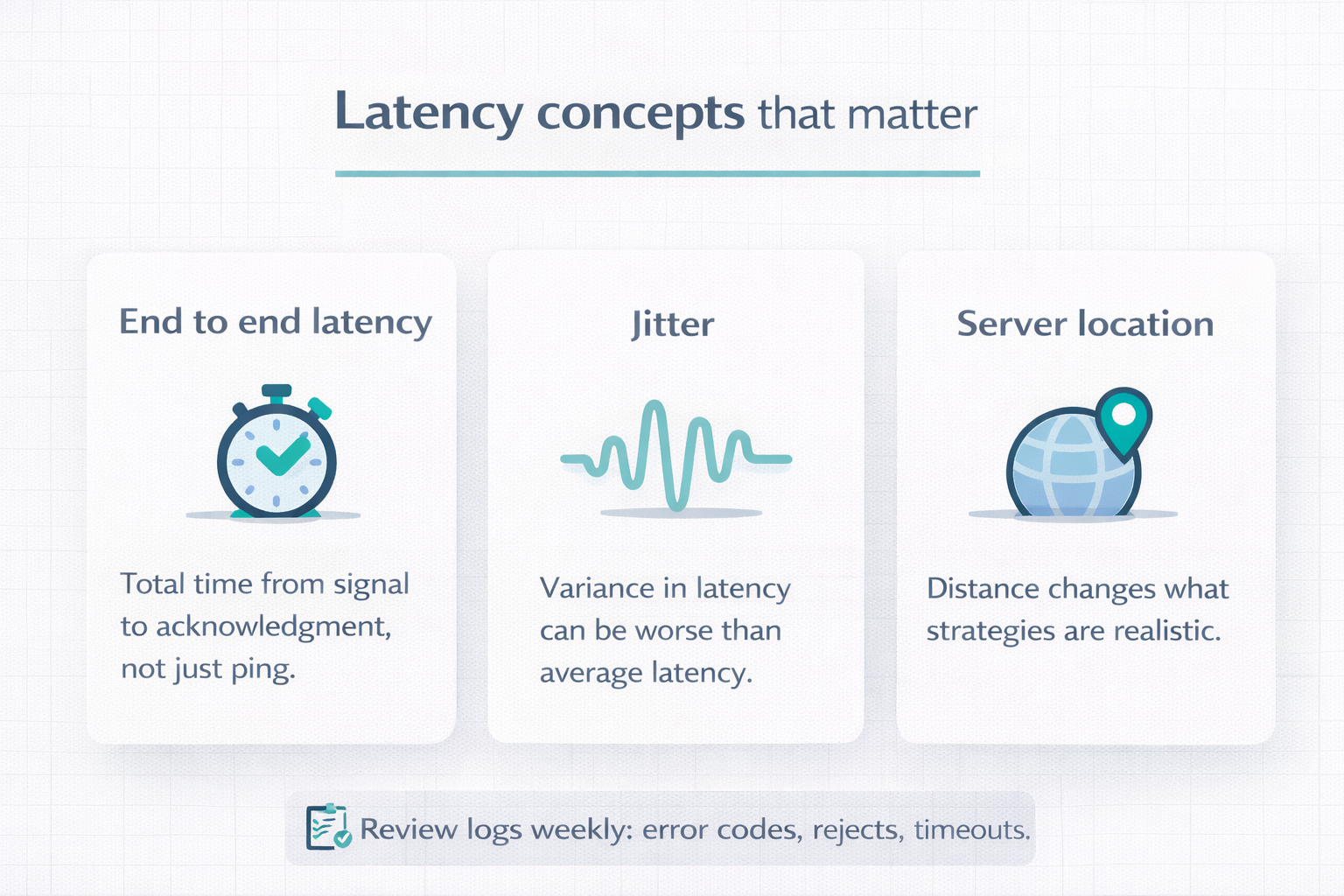

A weekly review of logs, error codes, rejected orders, timeouts, is often the first sign that your setup is pushing against the limits of what the firm or platform comfortably supports.

Latency: How Fast Is Fast Enough?

Latency obsession can lead retail traders down unproductive rabbit holes. For many swing or intraday strategies, the difference between 30ms and 80ms round trip time is negligible; for a hyper active scalper, it can be the difference between edge and no edge.

Key concepts:

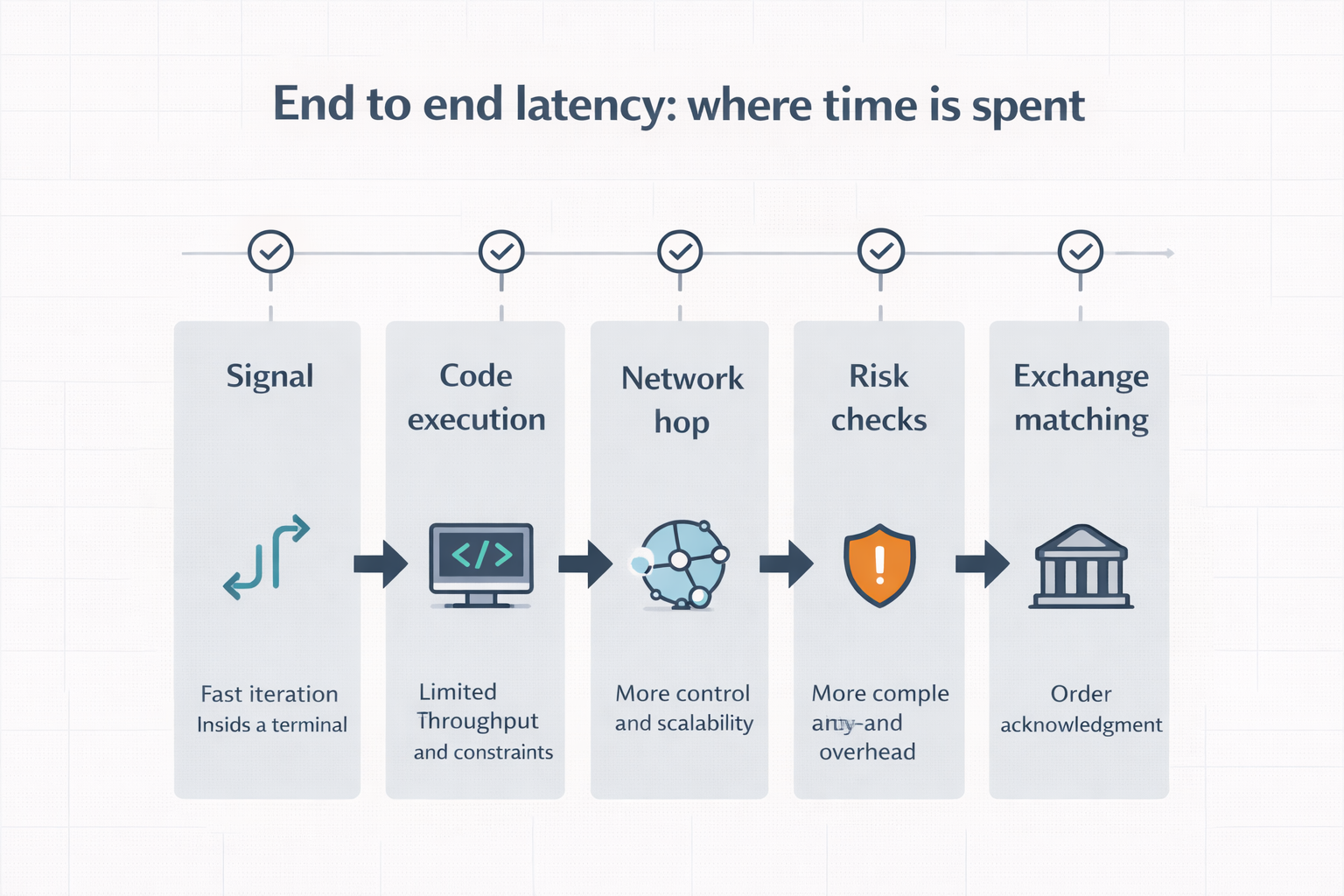

End to end latency. Not just ping to the server, but total time from signal generation to order acknowledgment. That includes code execution, network hops, risk plugins and exchange matching.

Jitter. Variability in latency can be more harmful than absolute latency for some strategies, especially when placing multiple related orders, scale ins, OCOs, etc.

Prop server location. A trader in Europe connected to a US based futures server may inherently see higher latency but can still trade effectively if the strategy is not micro scalping.

In a prop environment, it often makes more sense to accept moderate latency and design strategies with realistic hold times, rather than chasing ultra low latency that the firm may explicitly restrict or monitor for abuse.

Co Location and Near Exchange Hosting

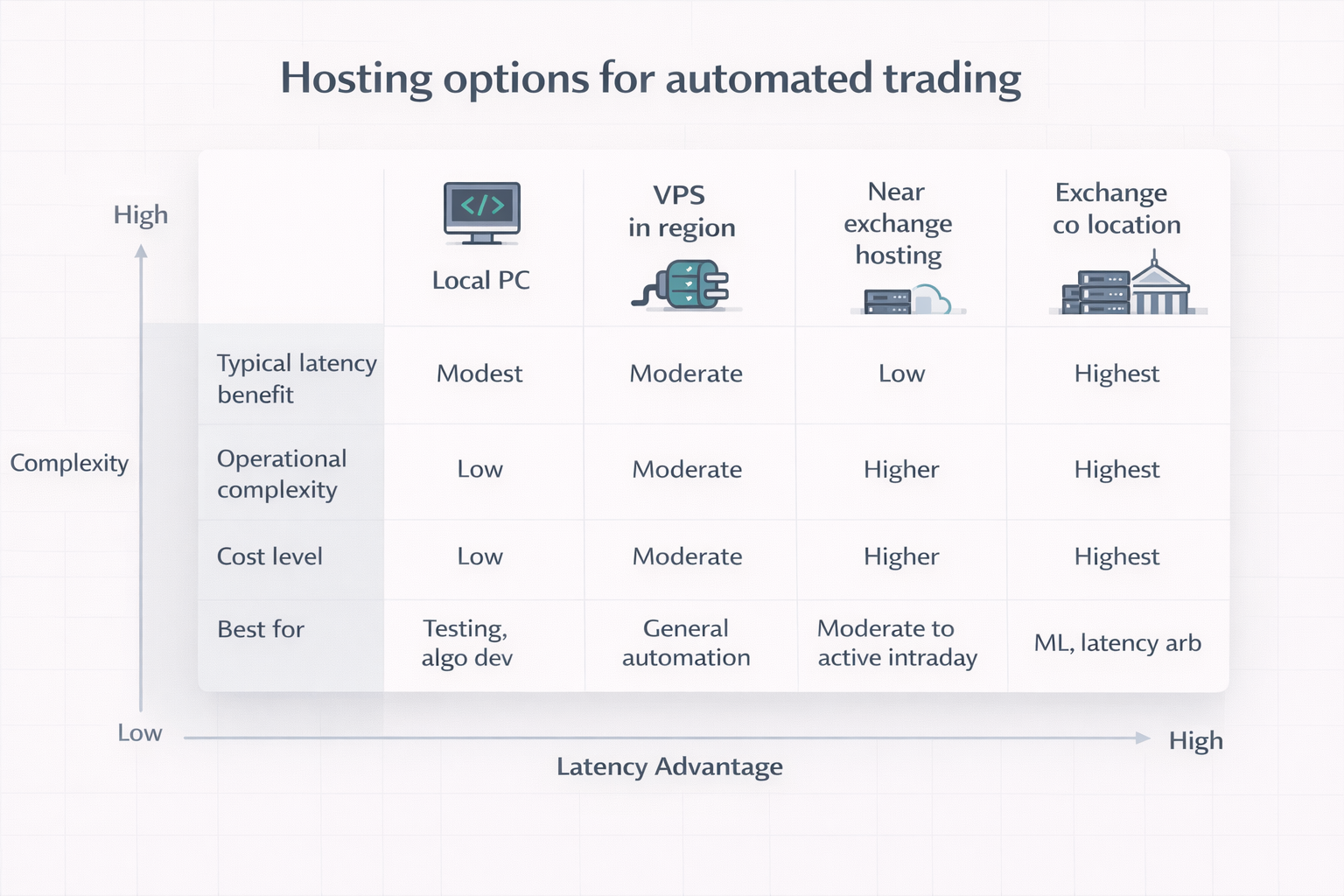

True exchange co location, where your servers sit physically in the same data center as the exchange’s matching engines, remains largely an institutional game. However, more retail facing providers now market near exchange hosting or low latency VPS solutions.

From a prop trader perspective:

- Many futures props already host their risk servers close to the exchange infrastructure. Your VPS near that same region can reduce one leg of the journey.

- Some firms may offer in house VPS or dedicated servers; while convenient, traders should confirm what level of access they have, root vs limited, and how backups and monitoring are handled.

- Co location does not guarantee profitability. It simply reduces a specific type of edge, or risk, but strategy logic, risk management and firm rules still dominate outcomes.

- When comparing prop firms, it is worth noting which ones provide clear technical specs: data center regions, recommended VPS partners, and any restrictions on hosting or cross connects.

Risk Controls, Kill Switches and Automation Limits

The more automated the strategy, the more important it is to have robust risk and safety mechanisms at both the trader and firm level. Prop environments frequently include:

- Daily loss and max drawdown limits enforced at server level.

- Max order and message rates to prevent abuse and malfunctioning algos.

- Hard blocks on trading around certain news events or in specific symbols.

On the trader side, a well designed automated stack should include:

- Local or server side kill switches that flatten all positions and disable trading on specific error conditions.

- Position and exposure limits applied in code, not just in your head.

- Clear logging and monitoring so that unexpected behavior can be diagnosed quickly.

Ignoring these elements can mean that a minor bug, an incorrect loop, a mis parsed signal, turns into a blown evaluation or funded account in a matter of minutes.

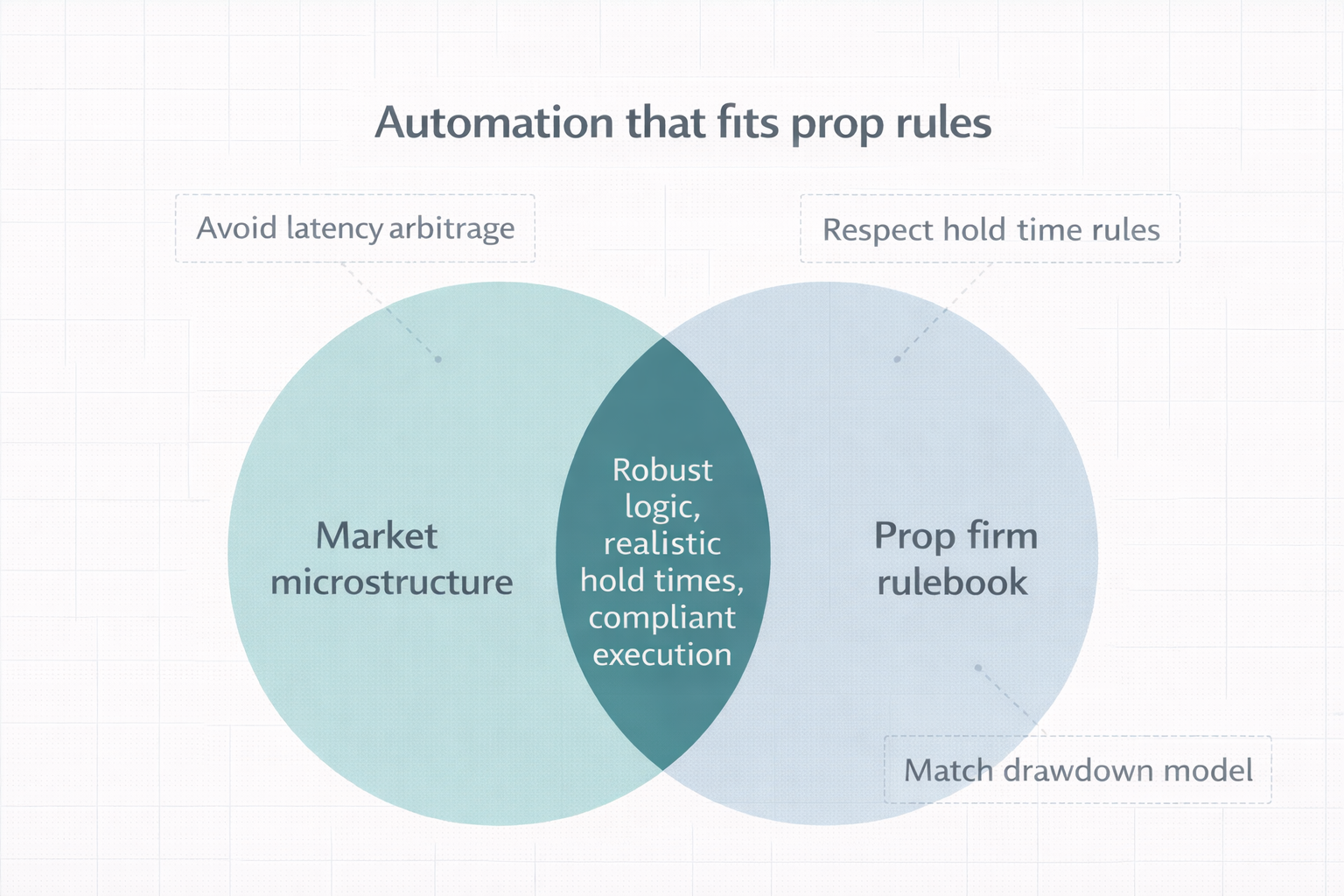

Designing Automation That Fits Prop Rules

The final piece is alignment: your automation needs to fit not just the market microstructure but the prop firm’s rulebook. That means:

- Avoiding strategies that rely on latency arbitrage or exploiting stale quotes; many firms explicitly monitor and penalize this.

- Respecting minimum hold times or prohibitions on hyperactive scalping where they exist.

- Making sure your risk profile, max intraday loss, typical drawdown, is compatible with the firm’s trailing or static drawdown models.

A weekly review should cover not only P and L and technical performance but also rule compliance: number of trades, exposure during restricted times, and any warnings or flags from the firm.

Weekly review checklist

- API and execution health: rejected orders, timeouts, disconnects, throttling, error codes

- Latency sanity check: end to end timing, jitter spikes, platform freezes during peak sessions

- Rule compliance: trade count, hold times, restricted windows, any warnings or flags

- Risk controls test: kill switch works, max exposure limits enforced, logging and monitoring intact

- Strategy fit: are you relying on speed tricks, or on robust logic and realistic hold times